There’s nothing easy about freelancing. There are perks, oh yes, wonderful perks that cubicle dwellers can only dream of, but it’s hardly piece of cake.

Freelancing puts our minds, bodies, and families to the test. It can be stressful, terrifying, and incredibly gratifying, but as a freelancer, you’re left to deal with each one of those in turn, all on your own.

Well, if you’re coworking, you’re never really alone. There’s an entire community of entrepreneurs going through each one of those stages right along with you. And we all know that misery (and joy!) loves company.

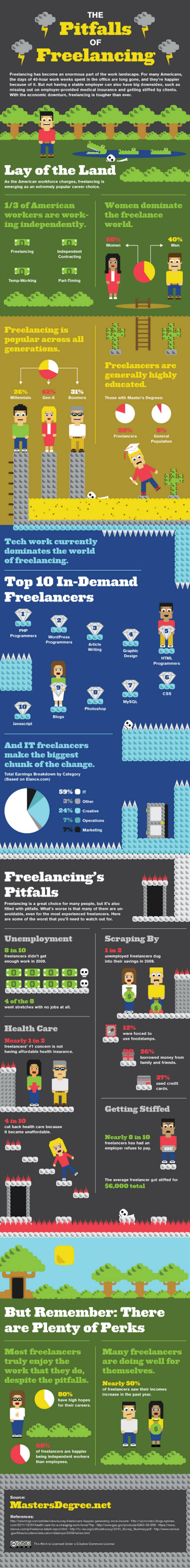

Check out the infographic below for some interesting stats about the highs and lows of the freelance life. Then keep scrolling for ways to tackle each.

Pitfall 1: Unemployment

This is a tough one, because every freelancer lives in that vague place between feast and famine. When contract end and you’re desperately in need of new work, what should you do? Well, as a coworking freelancer, you have a definite advantage. Others might start trolling sites like Elance or Guru, prepared to auction their time off to the lowest bidder, but not you. Coworkers are a built in network of lead generators. Before getting desperate, mention to a few desk mates that you’ve got time for new projects. Post your skills and availability on the Cohere Facebook group. Chances are, someone who knows someone will be calling for a meeting before you know it.

Pitfall 2: Scraping By

This is a continuation of Pitfall 1, because when you can’t find work, money dries up almost instantly. The best way to hedge your bets is to save more in times of plenty. Instead of splurging on expensive dinners or a new iPhone during busy months, stash an extra 10 or 20 percent in a high yield savings account. If you’ve always had trouble saving or sticking to a budget, online tools like Mint.com can help you get organized and remind you when you’re spending over your limits.

Pitfall 3: Health Care

This is a huge one. I don’t know a single freelancer that isn’t concerned about how to find or keep affordable insurance. The fact is that for all its heinousness, the corporate world does have one big advantage: group buying power. But freelancers are slowly eeking out a place for themselves in this industry as well. Check out the limited group plans offered by Freelancers Union. If that doesn’t help, check into possibly benefits offered by any professional organizations or unions you might be a part of. And if you’re not a part of one, think about joining. You’ll be surprised how easy it is, and it looks good on a resume too.

Pitfall 4: Getting Stiffed

Fighting with a client who always pays late or doesn’t want to pay at all? You’re not alone. Last month, freelancers from around the country added their unpaid invoices together and the total came out to be more than $15 million dollars. Because freelancers aren’t afforded the same protection as brick and mortar businesses when it comes to collecting unpaid bills, many of us end up eating these losses. There’s no guarantee that a crappy client won’t try to stiff you, but there are some definite steps you can take to minimize risk.

First, do your research. Once a deadbeat, always a deadbeat. Use this Client Scorecard to check a company’s track record before you sign on the dotted line. Second, always, ALWAYS use a contract. You can make one here, or ask any of our established members to share examples of the contracts they use. If a company presents one to you, make sure you understand every line before signing. Third, get partial payment upfront, especially if it’s a project over $1,000.

Do you struggle with any of these pitfalls? How have you overcome them? Share your experiences in a comment!