As soon as the New Year’s glitter has settled most people start thinking about Spring. Unless you’re an entrepreneur. Then you start thinking about taxes. Even the most experienced self-employed professionals gets a little nervous when tax time rolls around. There are so many moving parts, so many things to remember, so many receipts to lose, that it’s hard not to feel anxious about how everything will turn out.

This year, we’re not going to regurgitate the same old tax time tips. Most of them are only helpful BEFORE it’s time to file anyway. Instead, let’s look at some of the most important things to keep in mind as you get ready to file, quick and dirty style.

3 Quick & Dirty Tax Tips For The Self-Employed

1. W9 Extravaganza – You should always exchange W9 forms with a client or subcontractor before the work starts, but if you didn’t, DO IT NOW. Especially if any of your contact information has changed since you first started working together. Waiting just delays the ability of both parties to file their taxes. Doing this early also means plenty of time to correct errors or disputes if any arise.

2. Brace Yourself – It’s rare for the self-employed person to get a refund. In fact, most of us just want to break even. However, if you failed to make a quarterly estimated payment (or two), now’s the time to prepare for a big bill. And, if you haven’t been stowing money in a separate business savings account, start thinking about where that cash is going to come from. Taxes aren’t due until April, so you’ve got some time to move things around. Or start your Ramen diet.

3. Delegate – Yes, you’re smart enough to do your own taxes, especially with all of the “home business edition” software packages out there. But don’t. Even those programs aren’t fool proof. They’re only as good as the prompts, and if they don’t ask you the right questions, you’ll leave deductions on the table. When you work with a real person, you can ask real questions in real time, allowing them to get a better picture of your life and business, so they can choose the right deductions. Besides, hiring a tax prep professoinal is a deductible business expense for next year.

If you’ve found an amazing, independent tax prep professional, and they’re looking for new work, please share contact info in the comments. Freelancers love to hire freelancers!

Image: 401(K)2013

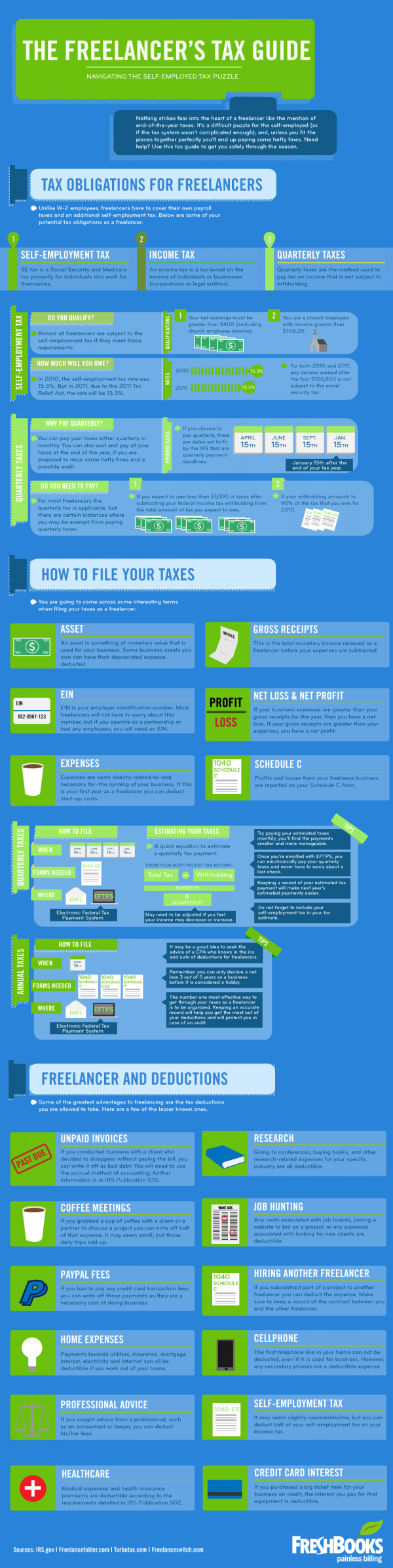

Infographic via Visual Loop